Table Of Content

- What is House Rent Allowance (HRA)?

- Can you claim HRA if you don’t live in a Rented accommodation?

- Is Rent Agreement mandatory for HRA exemption?

- What Documents are required for HRA exemption?

- What are the eligibilities for HRA exemption?

- How do I claim HRA through a Rent Agreement?

- How can I calculate my HRA?

- Do I need to submit proof for HRA?

- How much HRA can be claimed without proof?

- Is there any restriction on claiming HRA through a Rent Agreement?

- Can I claim HRA without Rent Agreement?

- FAQs

For what purpose does Home rent allowance come in handy? Yes. The home rent allowance is important. When it comes to claiming HRA (House Rent Allowance) as a deduction from your taxable income, rent agreement becomes a really important document to have as a corporate worker needs to submit his Rent agreement for HRA exemption. In this blog, we will discuss whether the rent agreement is mandatory for HRA and what are the documents you need to claim the tax deduction.

What is House Rent Allowance (HRA)?

House Rent Allowance (HRA) is an allowance provided by an employer to their employees to meet the cost of renting a house. It is a part of an employee’s salary and is taxable under the Income Tax Act. However, employees can claim a deduction on their taxable income for the amount of HRA received, subject to certain conditions.

Can you claim HRA if you don’t live in a Rented accommodation?

It is certainly a NO for claiming the HRA is needed and that can only happen when the person is living in a rented accommodation rather than having their own homes. If you fail to show a rent agreement for HRA exemption then you can not enjoy the benefits of Home Rent Allowance.

Is Rent Agreement mandatory for HRA exemption?

Yes, for the people working in the corporate field. The majority of employees’ salaries include a House Rent Allowance (HRA). Although it is a part of your pay, HRA is not entirely taxable, in contrast to basic income. If you want to claim HRA under the India Income Tax Act, you need to submit a copy of your rent agreement as it serves as the proof of your rent arrangement and the amount you are paying for the rented accommodation. A portion of HRA is exempt from taxation under Section 10 (13A) of the Income Tax Act of 1961, subject to certain conditions.

Before calculating gross taxable income, the HRA exemption amount is subtracted from the total income. An employee can save taxes in this way and that’s why rent agreement is required for HRA exemption. However, if an employee lives in his or her own home and does not pay any rent, the HRA received from their employer is fully taxable.

What Documents are required for HRA exemption?

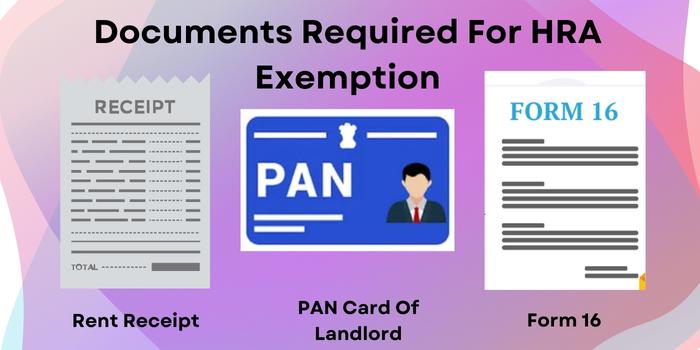

In Addition to a rent agreement, there are few other documents required for HRA exemption.

- Proof of Rent Paid: Rent receipts or the bank statement showing the rent payment need to be submitted while submitting the document to exempt the HRA deduction.

- PAN Card of Landlord: An employee must provide the PAN of the “landlord” if the rent paid exceeds Rs. 1,00,000 per year.

- Form 16: Form 16 is another important document to have to claim HRA deduction from your taxable income. It is a certificate issued by an employer mentioning the details of your salary and tax deduction.

What are the eligibilities for HRA exemption?

Documents required to claim HRA exemption is one important thing the other one is who all come under these conditions:

- The individual ought to be a salaried worker.

- His pay structure includes an HRA element.

- You must have a rent agreement in place.

- He ought to be residing in rented housing.

How do I claim HRA through a Rent Agreement?

To claim HRA through a rent agreement, you will need to submit a copy of the agreement to your employer. Your employer will then use this information to calculate your HRA and adjust your salary accordingly. It is important to ensure that the rent agreement includes accurate and up-to-date information about the property being rented, the duration of the rental period, and the amount of rent being paid.

Also Read, Do’s & Don’t while Drafting a Rental Agreement!

How can I calculate my HRA?

There are few different factors to be considered to calculate your HRA that includes your salary, the amount you are paying for rent, and the location of your residence. There are a number of online calculators and tools available that can help you estimate your HRA based on these factors.

Do I need to submit proof for HRA?

As discussed above, for HRA proof documents need to be submitted either rent receipt or bank statement showing the rent agreement payment. It depends on the amount such as if the amount exceeds more than 1 Lakh per annum then you need not to submit the proof and if the amount is less then you will be needing the proof to submit.

How much HRA can be claimed without proof?

You can claim HRA without providing rent receipts as proof if your HRA does not exceed Rs 3,000 each month. But when your HRA crosses Rs 3,000, you need to submit the rent receipt to claim the HRA.

Now the question also arises how much HRA can be claimed without pan? When your yearly rent payment is less than Rs. 50,000 -1,00,000, you can submit the claim for HRA without PAN of your landlord. When your rent reaches Rs 50,000 – 1,00,000, you must, nevertheless, obtain your landlord’s PAN.

Is there any restriction on claiming HRA through a Rent Agreement?

There are a few restrictions that you need to consider while claming the HRA through a rent agreement. For example, if you are renting a property that is owned by a family member, you may not be eligible to claim HRA. Additionally, you may not be able to claim HRA if you are not actually occupying the property for which you are paying rent. Finally, there are limits on the amount of HRA that you can claim based on your salary and the location of the property being rented.

Can I claim HRA without Rent Agreement?

No, you can’t claim the HRA if you don’t have the rent agreement. As discussed earlier, rent agreement is mandatory for HRA exemption. Although, few employers allow HRA deduction without rent agreement.

Therefore, we highly recommend you to have a rent agreement when renting a property to claim the HRA.

Frequently Asked Questions (FAQs)

HRA allowance is generally taxable, unless the employee is able to provide proof of actual rent paid and meets certain conditions set by the Indian tax authorities.

Yes, HRA allowance can be claimed as a deduction on tax returns if the employee is able to provide proof of actual rent paid and meets certain conditions set by the Indian tax authorities.

No, HRA allowance is only intended to cover the cost of renting a home and cannot be claimed for home ownership.