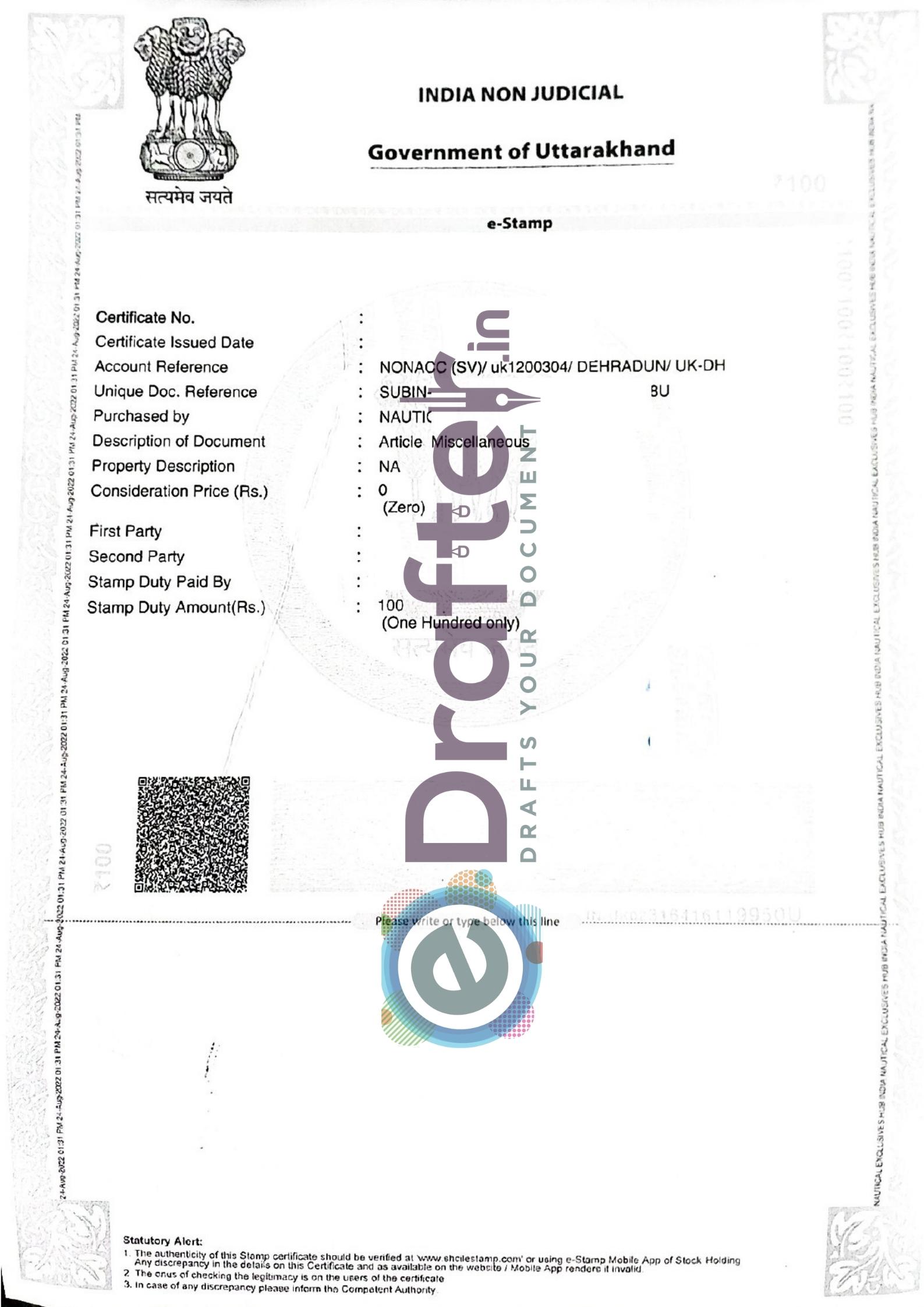

e-Stamp Paper of Uttarakhand

उत्तराखंड का ई स्टाम्प पेपरLoading...

Click to Buy another State Stamp Paper

Preview of e-Stamp Paper of Uttrakhand

Click to place Bulk Order

Knowledgebase

e-Stamp Paper means paying Stamp Duty to Government electronically. Currently, In there are 18 States where e-Stamp Paper available. The Karnataka State Government introduced the e-stamping system in the state in 2008. The Prevailing system of Stamp Paper has been replaced and stopped by Government and now there is only e-Stamp Paper which is more secure and reliable as compare to prevailing system of Stamp Paper.

Usually, not just in Uttrakhand but in India if you have purchased an Stamp paper that cannot be refunded or transferred. Therefore it is important to verify the details before buying an eStamp paper.

e Stamp paper is an electronic version of physical stamp paper which is introduced by state government to collect the stamp duty from citizens securely.

- Open website shcilestamp.com

- After that Click on “Verify e-Stamp Certificate

- Fill the Required Details.

Details include:

- State

- Certificate Number(UIN)

- Stamp Duty Type(Description of Document)

- Certificate Issue Date

- 6 character alphanumeric string

First Party means the purchaser of e-Stamp Paper. The Party who is executing e-Stamp Paper.

If there is no Second Party, then you can write NIL/Not Applicable while filling the Form and the e-stamp paper shall be generate accordingly.

Second Party can be Tenant, Vendee, Transferee, Donee etc. For ex: If you are purchasing e-Stamp Paper for Rental Agreement then in that case the First Party will be Owner and Second Party will be Tenant.

The Address field is a field provided by the Government to know the details about the Stamp Duty payer. So, its better to provide the Address of the Party OR you can also write Not Applicable in a field if you do not wish to get the Address print on e-stamp paper and e-stamp will be generated accordingly.