Table Of Content

- Meaning of stamp

- What is Stamp Duty?

- Types of stamps under the Indian Stamp Act are as follows

- Evidentiary value of an instrument not duly stamped

- Mode of Payment of Stamp Duty under the Indian Stamp Duty

- Conclusion

Throughout our lives, we have encountered many levels and types of transactions and documentation throughout our lives. Some of these records and transactions are extremely significant to the State and to us. It would be difficult to keep track of such transactions in the absence of any system for their regulation.

Meaning of stamp

As per section 2(26) of the Indian Stamp Act [inserted w.e.f. 10-9-2004], ‘stamp’ means any mark, seal or endorsement by any agency or person duly authorized by the State Government, and includes an adhesive or impressed stamp, for purposes of duty chargeable under the Indian Stamp Act.

What is Stamp Duty?

The tax due on any transaction based on the execution of instruments or exchange of papers as defined by statute is referred to as stamp duty. The type of duty can either be fixed or varies depending on what is subject to it. In essence, a document serves as a record of the terms to which the parties have come to an agreement. Such documents are regarded as genuine legal documents when they have been stamped or have had their stamp duty paid. The Indian Stamp Act of 1899 governs the imposition of Stamp Duty in India.

Types of stamps under the Indian Stamp Act are as follows

There are two types of stamps: –

- Judicial stamp– When you go to a court you need to pay court fees in a civil case you need to pay 4-5% fees depending upon the state. Court fees are paid in the form of stamps. Cash or cheque are not accepted. Stamps used in the court are judicial stamps.

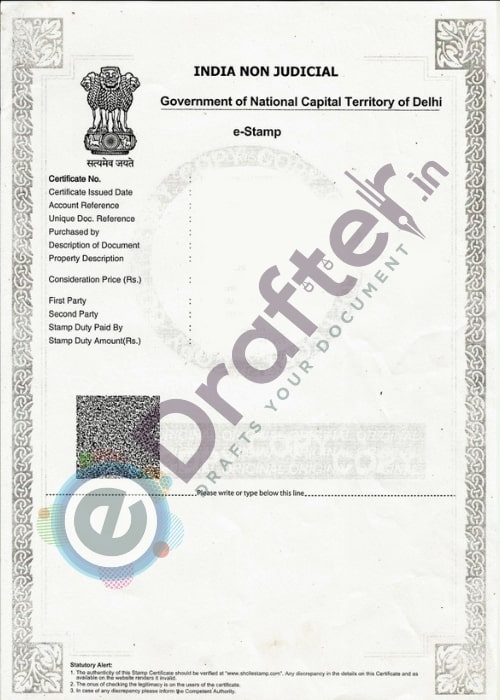

- Non-judicial stamp- While drafting any agreement, gift deed, rent agreement, or any other document regarding any agreement, you need to get a non-judicial stamp.

Evidentiary value of an instrument not duly stamped

Section 35 of the Indian stamp act 1899 does not allow an instrument chargeable with the duty to be admitted as evidence if it is not duly stamped, however, there are certain exceptions to this section and those exceptions are:

- Courts and arbitrators may admit documents which are unstamped or deficiently stamped on payment of proper duty and penalty.

- An unstamped receipt is admissible only against the person whose fault the receipt was not stamped on payment of a penalty of Rs. 1.

- When a contract has two letters attached and any one of those letters are stamped then in that case the contract will be treated as it is completely stamped.

Case Law – In K. Santhakumari vs K. Suseela Devi, AIR 1961 the point that fell for consideration is as to whether the Court could collect stamp duty and penalty at that stage even before the time of admission in evidence came in. It was held that “it is obvious that, if stamp duty and penalty are collected in advance and, later the document is not admitted in evidence, the party concerned would have to pay penalty equal to ten times the duty or deficit duty and take the chance of getting refund afterward under Section 39 and lose the chance of having to pay a smaller penalty in the first instance at the discretion of the Collector under Section 40 (1) (b) without the advantage of the document being admitted in evidence. This would cause undue hardship to the party”

Mode of Payment of Stamp Duty under the Indian Stamp Duty

The payment of stamp duty must be rendered in full. The collection of the stamp duty must be completed on time, or it will incur fines. It is a legal document which can be used in court as evidence and has meaning.

Payment of the obligation shall be made before the legal document is executed, at the time of execution, or within one working day afterward. The payment typically is made by the property’s buyer. In the case of an exchange of goods, both the party, such as buyers or sellers, shall be liable to pay stamp duty equally.

The penalty for insufficient payment of the stamp duty will be levied at 2% per month and up to a maximum of 200% on the amount to be paid.

Conclusion

Under the Indian Stamp Act, the assessment or computation of stamp duty is less difficult to understand. Furthermore, it gives the government a reliable source of money. If the collector has any doubts regarding the appropriate amount of duty to be charged for the document, they may, in line with the Stamp Act, write a statement of the matter and submit it to the Controlling Revenue Authority.