Table Of Content

- What is a Loan Agreement?

- How many parties are involved in the Loan Agreement?

- Types of Loan Agreement

- Clauses To Be Covered in Loan Agreement

- Is stamp paper required for loan agreements?

- Types of Stamp Paper in India

- Conclusion

- FAQs

There is a lot of debate about whether loan agreements should be on stamp paper or not. Some people argue that it is a waste of money, while others say that it is a necessary precaution. So, what is the truth? Let’s clear the clouds of such confusion in this blog below.

What is a Loan Agreement?

A loan agreement in India is a contract that governs the mutual promises made by the borrower and the lender. Loan agreements range from straightforward negotiated documents between families to more complex borrowers.

A Loan agreement is an elaborated form where each and every detail is written of both the borrower and lender. The parties can insert as many clauses as they want and also can mention specific details such as rate of interest, tenure of the agreement, etc.

How many parties are involved in the Loan Agreement?

Majorly people consider only two parties lender and borrower but in reality there are actually three parties including witnesses.

Lender

Is the person or a financial institution who provides a specific amount of money to an individual or a company who is in need of that money with the expectation that the money will be paid back. Any fees or interest are included in the repayment.

Borrower

is an individual or company that borrows money from another person for a reason. The money which is borrowed has to be repaid back to the lender.

Witnesses

Witness is the third party who is involved after. They can be considered as an important party as their job is to prove the authenticity of the borrower and is also someone who provides a repayment guarantee for the loan.

Types of Loan Agreement

There are two types of Loan Agreement:

- Secured Loan Agreement

- Unsecured Loan Agreement

Secured Loan Agreement

A secured loan is one that has collateral or security attached to it. This indicates that the lender has collateral or security to protect himself in the event of a borrower payment default. Typical collateral examples include a house, a car, jewelry, etc. Because there is collateral involved, it is the most popular sort of loan. The borrower’s borrowing cap is significantly larger than the cap on an unsecured loan.

Unsecured Loan Agreement

You can borrow money without putting up any security with an unsecured loan. The borrower’s borrowing limit is low and the lender’s level of risk is high because there is no collateral involved. Low borrowing capacity and high interest rates are the results. The lender’s alternatives for getting their money back if the borrower defaults are quite restricted. Credit cards and personal loans are the two most prevalent types of unsecured lending. The requirement for collateral may vary depending on the loan amount, the borrower’s income, and the borrower’s credit score. Personal loans, however, come in both secured and unsecured varieties.

Clauses To Be Covered in Loan Agreement

The clauses that are covered under the Loan Agreement are:

- Identities of the Parties: The agreement should contain the following details of the parties:

- Name of the lender, borrower & witnesses

- Address of both the parties.

- Contact number

- ID proofs (Aadhaar card, PAN card or Driving license)

- Date of Commencement: From the date when the Agreement is signed to the date till the Agreement is valid needs to be in the Agreement so that it is kept in record as to when the borrower has to pay the debts.

- Rate of Interest: The amount of interest that would be charged on the Debt amount which has to be paid by the borrower if not paid on time. The amount of interest which has been capped by the State and Federal laws should not exceed more otherwise it may be difficult to get the agreement upheld in court. And if not charging or charging too low can create income tax issues.

- Signatures: Signatures is a very prudent clause that can not be missed as the parties need to sign the agreement. Also, the witnesses are required to sign too.

Is stamp paper required for loan agreements?

The answer to this is yes, Stamp papers are mandatory for money borrowing agreements as whatever documents that are used for legal purposes it is compulsory to get it executed on a stamp paper because it becomes valid after that and notarizing those documents is not compulsory.

Also Read, Stamp Paper Vs Notary

Types of Stamp Paper in India

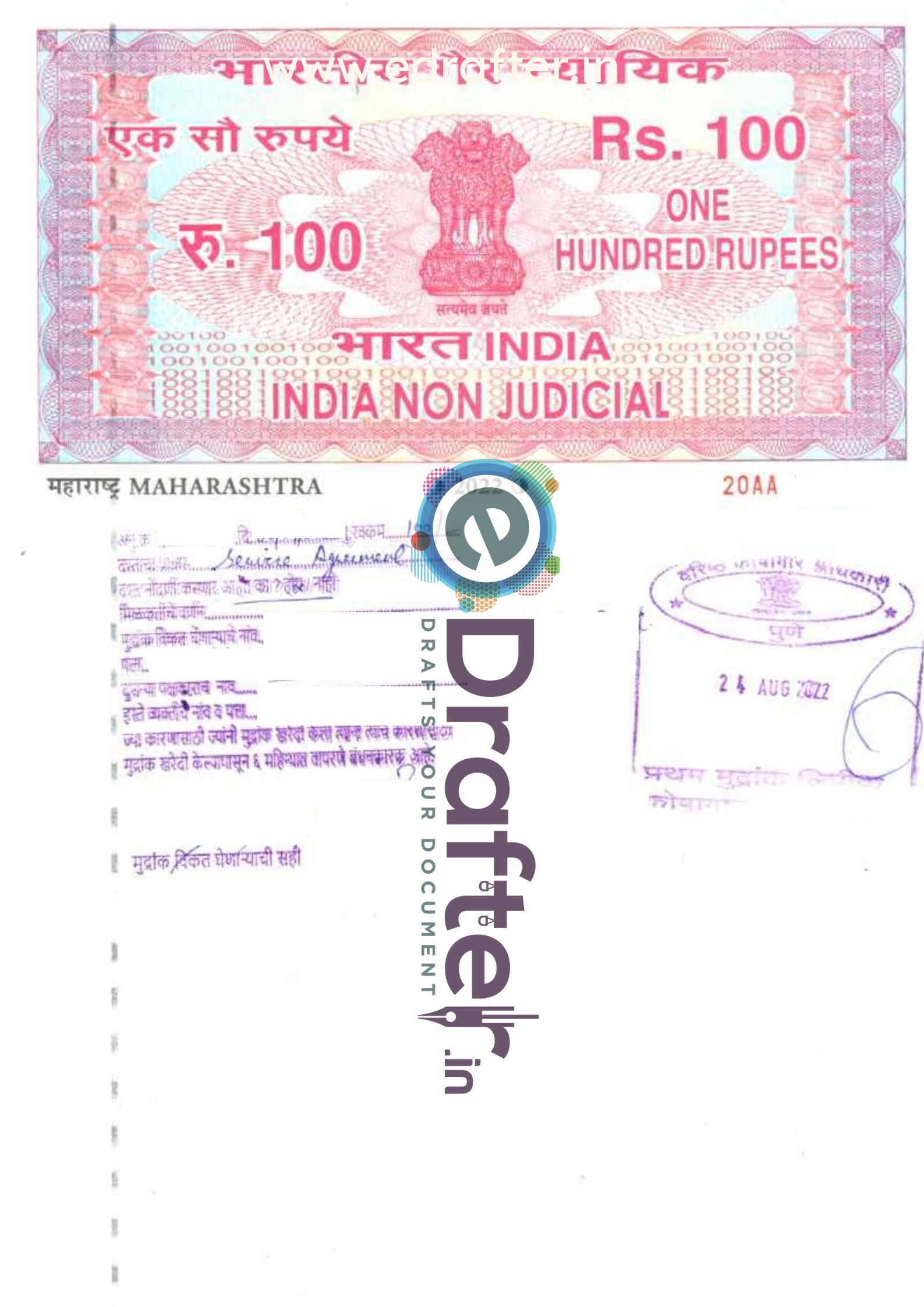

There are mainly three types of Stamp Paper that are legally valid in India:

Stamping through Court

There are some states where the stamp paper procurement is physical through courts wherein one needs to visit to the Government authorized stamp vendor and need to furnish the details.

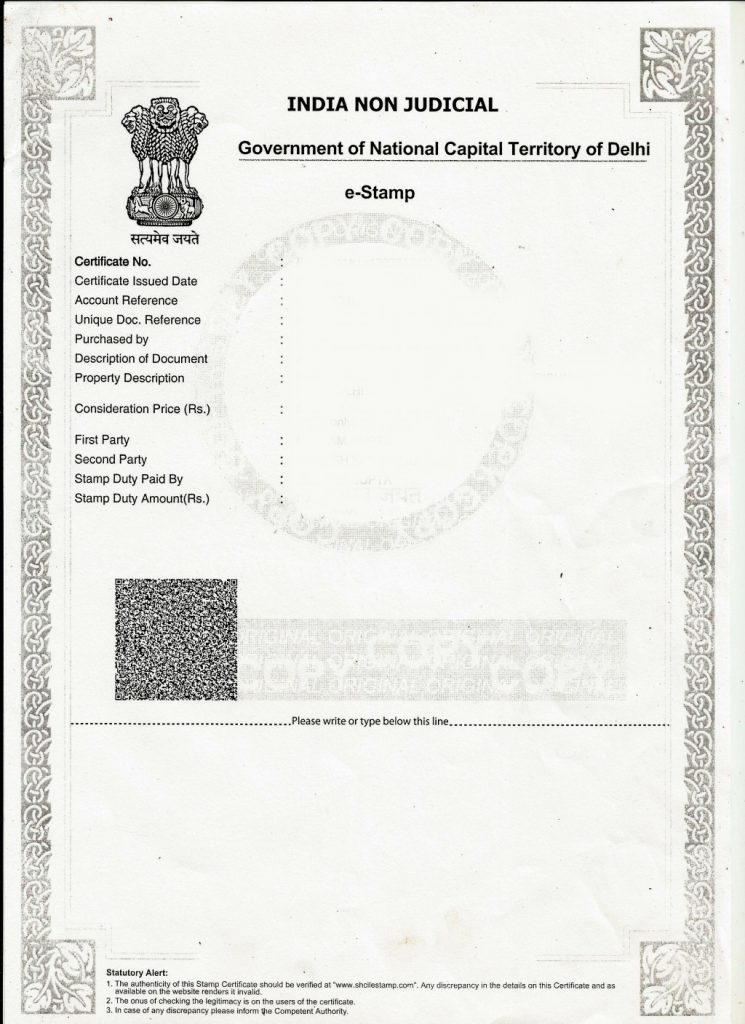

Stamping through SHCIL

The Government of India has appointed SHCIL as the only Central Record Keeping Agency (CRA). The citizens can pay stamp duty online and later on they will get a hard copy of the e-stamp paper. For the same, they can visit the authorized collection center.

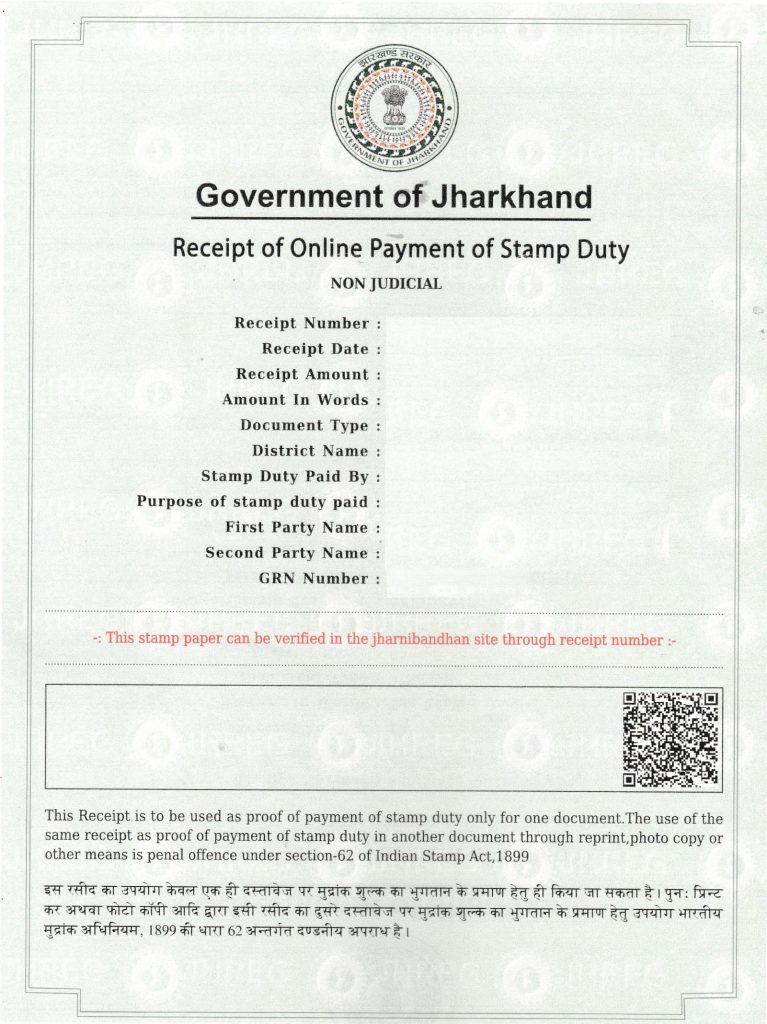

Stamping through e-gras

The Online Government Receipts Accounting System (e-GRAS). There are very few states where stamping through e-gras is applied where the public need not be present physically, they get their stamp papers online without any long hefty process.

Also Read, How get Stamp paper online?

Conclusion

The argument around whether loan agreements should be on stamp paper or not is ongoing. Some people believe that having a money agreement on stamp paper makes the contract more binding and can help in case of any disputes. Others feel that having a loan agreement stamp paper is not necessary and can be done on a regular piece of paper.

Frequently Asked Questions (FAQs)

What is the value of Stamp Paper for Load Agreement?

The stamp paper value for agreement that mostly is asked by the people are 100 & 500. Though 100 rs stamp paper for loan agreement is one of the commonly used stamp paper. Also, the stamp duty on loan agreement depends upon the Loan amount and upon the state of the parties as the stamp duty differs state to state.

What Stamp Paper is used for unsecured Loan Agreement?

When you take out a loan, the agreement is typically written on a standard piece of paper called a “stamp paper.” This document serves as a record of the terms of the loan and serves as protection for both the borrower and the lender. The agreement stamp paper is usually signed by both parties and then notarized by a lawyer or notary public.

Is Loan Agreement required to be registered?

Most people are not aware that a loan agreement needs to be registered in order to be valid. Without registration, the agreement will not be legally binding and the lender will not be able to recover the money if the borrower defaults on the loan.