Table Of Content

- How can I Recover Money from Someone Legally?

- Why is a Legal Notice required to collect Money?

- In what Money cases a Legal Notice can be Sent?

- Is it mandatory to send a Legal Summons to collect Money?

- What Content should be included in a Money Recovery Legal Notice?

- Is there any Time Limit for Money Recovery Legal Notice?

- What if Someone is not Returning Money even after Legal Notice?

- What Legal Action can I take if someone is not Returning my Money?

- What is the CPC section for Money Recovery?

- What if I Received a Money Recovery Legal Notice?

- How to send a Legal Notice for Recovery of Money through eDrafter?

- Case Study

- Conclusion

In the area of financial transactions, disputes on unpaid debts can often be a troublesome subject for many. As per records, on an average every Indian Citizen is in an unpaid debt of around INR 1 lakh. Pursuing owed funds can be a complex journey that requires a distinctive understanding of Legal pathways and protocols. We will discuss the process & shed light on the easy way of issuing a Legal Notice for Recovery of Money. This informative journey will enable you to take assertive steps to reclaim your financial assets.

How can I Recover Money from Someone Legally?

If you want to Legally get Money back from someone, start by reporting your claim and trying to work out an amicable solution. Then If unsuccessful, issue a Legal Notice for Recovery of Money. If the debtor still defaults, consider filing a suit for Recovery of Money in small claims court or hiring a collection agency. Seek Legal advice in complex cases.

How to Recover Money when borrowed from an Individual?

Borrowing from an Individual involves the people you refer as ‘friends’ mostly. So taking things to a Legal level could be awkward and hesitant because you don’t want to ruin the relationship. But if the individual is not returning the owed amount after multiple reminders and it has been a long time. Then things can get serious where it can become a Legal matter later. There are two different processes through which one can Recover their Money.

First Procedure

File a Complaint in a nearby police station OR online at the respective state Government’s website. You can file a complaint alleging either Theft of the Money as per Indian Penal Code Section 379 Or against Cheating as per IPC Section 420.

Nowadays filing an Online FIR is easy & convenient that the Government has given in order to lower down criminal cases. Many major states like Tamil Nadu, Himachal Pradesh, Jharkhand, Maharashtra, New Delhi, Madhya Pradesh, Haryana, Patna, Odisha, Bangalore and Karnataka. As per IT Act 2000 the e-FIR is a valid Document and authenticated as compared to the offline FIR hence nobody can challenge the authenticity.

Second Procedure

You can send a Legal Notice for Money Recovery; Sending Legal Notice by advocate is a common practice. Legal Notice serves as a warning for the receiver to return the borrowed Money within this given time period else the matter can go in the hands of the court.

Though in many cases the receiver tries settling things out after getting the Legal Notice because no one wants to fight a case in the court. Reason wastage of extra Money and time. Still if the receiver does not revert back on the Legal Notice then you can take the further course of Legal action and file a case in the Court.

How to Recover Money when borrowed from a Financial Institution?

Nowadays people are more drawn towards financial institutions and lending apps which give away the Money through a very easy and convenient way. People are lured towards their fancy offers and low interest charge rate so it becomes easy for the people to borrow from them at the times of emergencies. Kishtt, Stashfin, Mpockket and Kreditbee etc are few apps that lend Money online. If an individual has taken Money from a financial institution, then their Legal process is clear.

- First they send multiple reminders through messages and calls individually for a due payment for quite some time and still in case of non-collection of payment. If the Customer missed out the deadline even after multiple reminders then firstly they restrict the activity of the concerned Customer on their app so that they can not take any further loan from them and send the report to the Cibil about the Defaulter which impacts the Financial record health of the Customer. Only the registered Financial Institution and Lending Apps can send the monthly-report to the CIBIL. These institutions & Apps are required to be registered under Non Banking Financial Company (NBFC) to become authentic & trusted bureau.

Note: CIBIL (Credit Information Bureau India Limited) has been given a license by the RBI under which they keep the record in respect of the Loan and Credit cards. When someone applies for a Loan/Credit Card then a lending authority checks their CIBIL Score and on the basis of that they approve/disapprove the application. The Ideal Cibil Score should be 700-749 and if under your CIBIL any Loan OR Credit Card has been marked as “Settled” then that as well gives negative impact towards your Financial Health.

- After restricting the customer to proceed with any Transaction from their app, the Institution sends a Legal Notice for Recovery of Money. By giving a reply to Legal Notice of the creditor you can ask for some extra time by stating the valid reason or else it needs to be adhered to.

- If an Applicant has not returned the Money even after crossing the deadline as per the Legal Notice by advocate then the Institution takes the suit for Recovery of Money in the Court while filing a case.

Why is a Legal Notice required to collect Money?

Legal Notices are important for Recovery Money because they serve as a formal warning to the debtor and clearly state the nature of the claim and the intention to take Legal action if the debt is not resolved. This official Document creates a Legal record of the claim and provides evidence of the creditor’s efforts to collect unpaid funds. It also gives debtors the opportunity to resolve their issues without resorting to costly and time-consuming litigation. In addition, a Legal Notice helps demonstrate that all reasonable avenues for an amicable settlement have been considered and strengthens the creditor’s position in subsequent Legal proceedings.

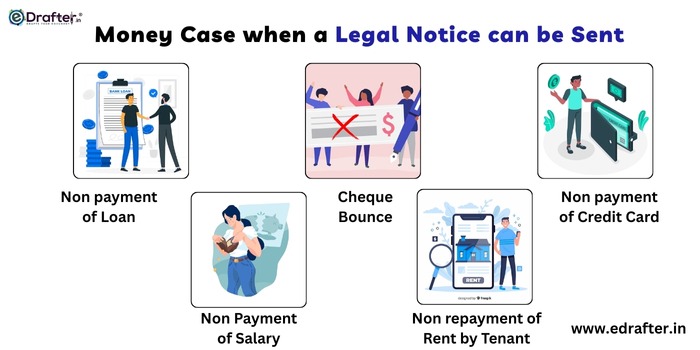

In what Money cases a Legal Notice can be Sent?

The Cases where you can send a Legal Notice to claim your Money are as follows:

- Non payment of Loan: If the individual has taken a loan for any purposes may be to start a business or for education purposes and due to some uncertain reasons he/she isn’t able to repay the loan on time. As per Negotiable Instrument Act under Section 138, financial institutions are liable to send Legal Notice for non payment of loan.

- Cheque Bounce: There are various cases where people make payments using cheque despite not having the sufficient amount in their bank account, that results as bounced cheque. In the situation, you can send them a legal notice under section 138 which is also known as cheque bounce notice.

- Non payment of Credit Card: There are cases where people use up their credit card limit and hesitate to pay it back. Even after many reminders the customers don’t pay any heed to it then a Legal Notice is issued to the customers to repay the Money back and do the settlement. This affects their Credit health as well.

- Non Payment of Salary: As per the Code of Civil Procedure Section 80 an employee is liable to send a Legal Notice for non payment of salary to his/her employer if they fail to pay their Salary for the month. In this the employee needs to cover all the relevant points in order to claim his/her salary. Suppose the employee and employer might be in a dispute and are terminated due to his inappropriate behavior then the situation can go in the favor of the employee if he has valid stands to point out in the Legal Notice.

- Non repayment of Rent by Tenant: There are cases where the Landlords get irritated by the tenant due their non payment of rent. The tenants might delay the payment or skip the rent by shifting the paying date to the next upcoming month. These are some loopholes which a Landlord faces. To avoid these they can send Legal Notice to Tenant to start paying on time or you can further send him a legal notice to vacate the rental property.

You can also send legal notice for Divorce and Defamation to other party to seek appropriate remedies within the law.

Is it mandatory to send a Legal Summons to collect Money?

Sending a Legal Notice isn’t always required to Recover Money, but it’s often a prudent first step. It serves as a formal communication indicating your intention to take Legal action if the debt is not paid. This Notice provides a clear record of your claim and can be used as evidence in court.

However, there are exceptions. In some jurisdictions or for smaller amounts, either you can send a Legal Notice by advocate or file a Complaint in nearby Police Station. This decision totally lies in the hands of the Lender.

Sending a Legal Notice is a recommended best practice. It demonstrates your commitment to Legally collect the debt and gives the debtor an opportunity to settle the matter without resorting to litigation. It also provides a clear deadline for actions that may be crucial in court proceedings. Always consult an attorney to understand the specific requirements in your jurisdiction.

You read our detailed blog on Legal Notice vs Court Notice to know the difference between these notices.

What Content should be included in a Money Recovery Legal Notice?

A draft Legal Notice for Recovery of Money format should include the following key elements:

- Notification date: Enter the notification issuance date.

- Information of the Creditor: name and contact information of the sender (creditor).

- Debtor Information: name and details of the caller (debtor).

- Purpose: Clearly state the purpose of the Notice: to demand repayment of a specific debt.

- Debt details: Debt details such as debt amount, transaction date and related terms and agreements.

- The basis of the claim: referring to Documents or contracts supporting the claim, such as contracts, invoices, promissory notes, etc.

- Demand for payment: A clear & unequivocal statement requesting debtor to repay a specified amount within a reasonable period of time.

- Payment Method: Specify the method of payment (eg, bank transfer, check, etc.) and provide necessary details such as account information.

- Interest or penalty (if applicable): If there is interest or penalty associated with the debt, state them clearly.

- Response Time: Set a reasonable time within which the debtor must respond or make payment.

- Consequences of Violation: Make it clear that failure to comply with the Legal Notice for Money Recovery format may result in further Legal action.

- Contact Information: Provide contact information for questions and answers from the debtor.

- Signatures of the Advocate: The Advocate signature should be placed at the very end of the Notice. It is important because without it the Notice is considered as invalid.

Is there any Time Limit for Money Recovery Legal Notice?

The time period for filing lawsuit for the Money Recovery may vary on the jurisdiction and nature of the claim. In many cases, there is no strict Legal deadline for sending Legal Notices. However, it is a good idea to act quickly to file your claim & avoid potential issues with statutes of limitations.

A statute of limitations for Recovery of Money is a statute that sets the maximum amount of time within which a Legal action can be brought after an accident occurs. These vary by jurisdiction and type of claim. In the case of debt and contractual obligations, statutes of limitations usually begin on the due date of the debt.

Although sending a Legal Notice is not required, it is a recommended step because it creates an official record of the claim and indicates your intention to pursue the matter Legally. Additionally, Legal Notices usually include a reasonable deadline for the debtor to respond or settle the debt. Else not paying the EMI’s to the creditor timely can affect your credit score. It can hamper your financial freedom in near future.

What if Someone is not Returning Money even after Legal Notice?

There is no worry if the debtor has not reverted back on the demand Notice for Recovery of Money. By sending the final draft of Legal Notice for Recovery of Money you did your job by warning the debtor after that it is the debtor’s work whether to take it seriously or not because in the Recovery Notice format you have mentioned the consequences of ignoring it. Then if the reply doesn’t come then you may proceed with the further actions after the expiration of the leverage period.

The actions you can take after that are:

- Direct file suit for Recovery of Money in the court.

- You can even file a criminal complaint against the debtor for the Recovery of Money with an extra penalty.

What Legal Action can I take if someone is not Returning my Money?

If someone doesn’t return your Money, there are several Legal steps for Recovery of Money:

- Send a formal demand letter: Start by sending a formal demand Notice for Recovery of Money. Provide details of the debt, including amounts, dates and any agreements in writing.

- File a small claims lawsuit: If the amount owed is within the limits of your local small claims court, you can file a lawsuit without needing a lawyer. Small claims court is designed for simple cases involving relatively small amounts.

- Mediation or Arbitration: Consider alternative dispute resolution methods such as mediation or arbitration. These processes can be quicker and less formal than court proceedings. Also it can often result in a resolution without the need for litigation.

- File a civil action: For larger amounts, you may need to file a civil action in the appropriate court. This process usually requires Legal representation.

- Get a judgment: If you win a lawsuit, you get a judgment. This is a Legal order that states that the debtor owes you Money.

- Enforcement of the judgment: If the debtor does not pay even after the judgment, you may have to take further steps to enforce it. This can include wage garnishment, bank levies or asset seizure.

- Hire a debt collection agency: Consider hiring a debt collection agency to collect the debt on your behalf. They usually charge a percentage of the amount withdrawn.

It is important to consult with an attorney to understand the specific procedures and options available in your jurisdiction.

What is the CPC section for Money Recovery?

In India, the section of the Code of Civil Procedure (CPC) for Recovery of Money under CPC is mainly covered by Regulation 21. This part of the open Open Securities Rules (OSR) describes various procedures and mechanisms for the enforcement of court decisions and orders, including those related to the Recovery of Money.

Specifically, Order 21 Recovery suit under CPC contains provisions for the following:

- Enforcement of decrees and orders: This section provides a framework for the enforcement of judgments and decrees passed by a court, which may include orders for the payment of Money.

- Garnishment: Outlines the process of garnishing a judgment debtor’s property as a means of collecting Money owed.

- Sale of immovable property: This section describes in detail the procedure for selling immovable property in order to comply with the decree.

- Arrest and Detention in Civil Jails: In certain cases, the court may order the arrest and detention of the debtor for non-payment of the decree.

- Attachment of salary, allowances and pensions: This section deals with attachment of salary, allowances and pensions of civil servants.

- Appointment of administrators: The court may appoint an administrator to manage and dispose of the property to satisfy the decree.

It is important to consult a Legal professional or refer to specific sections of the CPC for detailed and up-to-date information on procedures of suit for Recovery of Money under CPC in India. Keep in mind that Legal procedures and codes may be subject to modification and change over time. Though the Money Recovery suit case laws goes to this extent only if the borrowed amount is huge which goes up to lakhs. For the amount as such thousands you can send Legal Notice for Recovery of Money but it does take time for the court to look into it since the amount is not that big.

What if I Received a Money Recovery Legal Notice?

If you borrowed Money and due to some uncertain reasons are not able to pay it back then you should first justify your stand if received a Money Recovery Legal Notice. The act done by you was unintentional then revert back on the Money Recovery Legal Notice with your points. When you reply to a Legal Notice for Recovery of Money from the creditor you should cover all the points. Such as:

- As an assurance of you repaying the amount you are liable to write down the duration till when you will be to pay back.

- You want to pay back in lump sum or in EMI.

- You will payback bearing the whole interest or requesting to waive off some percent of it.

- Most important validation for not being able to pay the borrowed amount timely. The creditor is liable to the reason behind the delay in repaying the amount.

And if you have already repaid the amount, you should reply to the Legal Notice format of the creditor to take back his case with the attachments of proof when you repaid the amount. Date & Time are important factors here , through which mode you repaid it. Online transaction through bank transfer, UPI, Net banking etc.

How to send a Legal Notice for Recovery of Money through eDrafter?

As you already know that we have started a new service of Legal Notice. Through which you can send a Legal Notice for Money Recovery from a friend or any other person becomes easy. We made a simple and easy process for the customers to place an order within minutes. We will help you from the start till the end. The process to send a draft Legal Notice for Recovery of Money format is as follows:

- Visit our website www.edrafter.in

- Then click on the ‘Services’. Choose ‘Legal Notice’.

- After that, I registered for Legal Notice service.

- Our experienced Advocate will contact you for the details.

- Tell the Advocate of what needs to be covered in the Legal Notice.

- The advocate will mail you your Legal Notice draft after he has made corrections.

- Get the corrections done if any are needed.

- After that once all the corrections are done, you can send where you need.

Case Study – Legal Notice sent for Breaching the Trust and Cheating

One of our clients Akash Kumar helped his close friend Pranav with accommodation in Banglore by offering him a place to stay for the time being. Pranav assured our client Akash by saying “he will look for his own place soon”. Our client Akash took the bait of trust. With the passing of time, Pranav relied on our clients’ resources for groceries, bills, shopping, etc. After quite some time Akash requested his money back so Pranav listed various reasons for to delay and ended up borrowing more for a friend’s hospital bills. Again when Akash pressured for repayment, Pranav ignored all the modes of communication through which Akash could reach out to him. Even misbehaved rudely with our client. In response, our client chose to get legal help and sent a Legal Notice under the Indian Penal Code, demanding 1,00,000/- for the damages and the borrowed amount. Within 10 days after receiving the Legal Notice Pranav returned the whole amount to Akash without any more arguments since Pranav knew that further argumentation would lead to legal chaos for him.

Conclusion

Repaying the debts timely is beneficial for an individual as it boosts their credit health and trust on the creditors. So in the future they can get huge credit loans easily. Also as a creditor, if you’re tired of mischief and troublesome debtors, get your Legal Notice for Recovery of Money prepared by us. We’ll be there to serve you in your thick and thin at a very reasonable price.