Table of Contents

House Rent Allowance (HRA) is one of the most useful tax-saving components for salaried employees. If you’re living in a rented space, you can claim HRA and reduce your taxable income. But is a rent agreement really required to claim HRA? What if you’re staying in an informal setup or paying rent in cash? In this blog, we will discuss how rent agreements work legally, practically, and tax-wise.

Is rent agreement important for HRA exemption?

A rent agreement is not just a document between landlord and tenant. It’s also a key proof that rent is genuinely being paid. While the Income Tax Act itself does not explicitly mandate a rent agreement for HRA, most companies and HR departments ask for it, especially when the rent amount is significant.

The agreement helps establish who the landlord is, where you’re staying, and what rent you’re paying. It also helps confirm that you’re actually a tenant and not claiming HRA falsely. In simple terms, it’s not always mandatory but it’s very important. It keeps the process clean, reduces questions from HR, and protects your claim if ever scrutinized.

Can I claim HRA without a rent agreement?

Yes, it’s possible but it depends on how well you can prove that rent is being paid. If you have bank transfer records or rent receipts, some employers may still accept the claim. But remember, whenever the rent amount is high, or if you’re claiming HRA for many months at once, it’s common for employers to insist on the agreement.

You can still claim HRA without it if rent is regularly paid through the bank, you have written acknowledgment from the landlord, you can produce rent receipts, or you submit the landlord’s PAN if rent exceeds ₹1 lakh yearly.

However, if you’re hoping to claim HRA during tax filing without any document other than your word, that won’t work. Proof is still required, and a rent agreement is the simplest and strongest proof. But you need to know the recently changed rent agreement rules 2025.

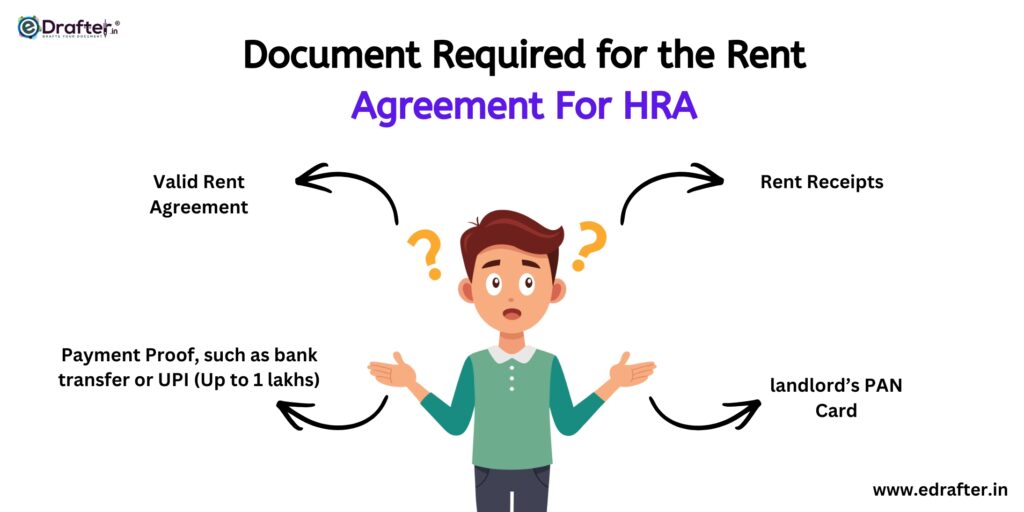

What documents do I need for Rent Agreement for HRA?

To ensure a smooth HRA claim, these are generally needed: a valid rent agreement, rent receipts, your landlord’s PAN if rent is more than ₹1 lakh annually, and payment proof such as bank transfer or UPI. With these documents in place, you can claim HRA confidently no questions, no rejection risk.

What is the process for creating an online rent agreement?

Gone are the days when you had to hunt for stamp paper sellers, find a typist, and then meet a notary. Today, everything can be done online legally, easily, and affordably.

Here’s how the online process works through eDrafter:

1. You visit the website

2. Choose the Rent Agreement option, and fill in the details like tenant and landlord name, rent amount, and duration.

3. After submitting the information, the agreement is drafted, reviewed, and printed on legally valid stamp paper.

4. Once approved, it’s signed and either delivered to your home or shared digitally if you prefer a soft copy.

The entire agreement is legally recognized, and you never leave your couch. It’s fast, official, and saves you time.

How much stamp duty do I need to pay for rent agreement for HRA?

Stamp duty isn’t the same everywhere. Each state has its own rates. But the good news is for most employee rent agreements (usually 11 months), the duty is minimal.

To give you an idea:

1. Delhi usually uses ₹50 or ₹100 stamp paper

2. Maharashtra charges 0.25% of rent + deposit

3. Karnataka ranges between ₹20 and ₹200

4. Haryana typically uses ₹50 or ₹100

The amount of stamp duty has no impact on your HRA eligibility but having it properly stamped ensures it’s legally valid. A document that’s not stamped may be considered invalid if ever questioned.

Why choose eDrafter for rent agreement online service?

Because it’s simple, quick, and reliable. Most people don’t know legal formatting or stamp duty rules. With eDrafter, you don’t have to. Instead of running around or worrying about mistakes, the process is handled by professionals. You get a legally drafted agreement, printed on the right stamp paper, and delivered to you without any stress. It works for tenants who need documents for HRA, and for landlords who want everything recorded properly.

Conclusion

So, can you claim HRA without a rent agreement? Technically yes but practically, it often becomes difficult. A rent agreement makes things safe, clear, and hassle-free. It lets you claim your tax benefit smoothly, without second-guessing the paperwork.

If you’re staying on rent, don’t leave it to chance. Create a proper rent agreement and protect both your HRA claim and your legal rights as a tenant. With services like eDrafter, it’s now a simple process that takes just minutes and saves you from future trouble.