Table of Contents

The Reserve Bank of India (RBI) is the central bank of India, which supervises all the banks and financial institutions in the country. The RBI has a structured mechanism to help consumers raise grievances against banks and financial institutions. Filing an RBI consumer complaint can help you get justice, ensure accountability, and protect your financial rights.

In this article, we’ll explain what the RBI is, when and how you can file a consumer complaint to the RBI, the process to submit an RBI consumer complaint online, and how platforms like eDrafter can make the process easier for you.

What is RBI?

The Reserve Bank of India is the central banking authority of India. It regulates banks, manages currency, monitors inflation, and ensures the stability of India’s financial system. But beyond these big functions, the RBI also acts as a protector of consumer rights in the financial sector.

Through its redressal mechanisms, the RBI provides a channel for individuals to raise complaints against banks and payment service providers. This ensures that financial institutions operate fairly and that consumers have a voice.

Can I Register a Consumer Complaint to RBI?

Yes, you can. If you have a grievance related to your bank or financial institution that remains unresolved even after approaching them directly, you are entitled to file a consumer complaint with the RBI.

Example: Imagine that your bank ignores your request to close an account, delays in processing a loan, or wrongly deducts money from your account, you can submit your complaint with the RBI. The RBI accepts complaints through its official grievance redressal system, including the RBI consumer complaint online portal. The key is that you must first approach your bank. If they fail to respond within 30 days or give an unsatisfactory reply, only then can you approach the RBI.

Against Whom Can I File a Complaint to the RBI?

The RBI allows consumers to file complaints against a wide range of financial entities. These include:

- Scheduled commercial banks

- Regional rural banks

- Urban cooperative banks

- Non-banking financial companies (NBFCs)

- Payment service providers such as wallets or prepaid instruments

In Which Cases Can I File a Consumer Complaint to RBI?

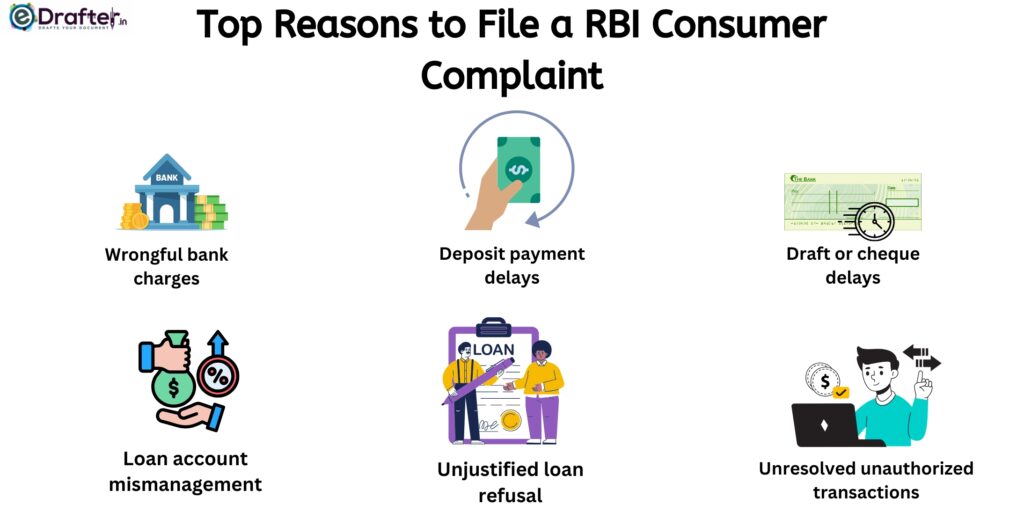

The RBI has listed several scenarios where consumers can raise grievances. Some of the common ones are:

- Wrongful charges, fees, or penalties imposed by banks

- Non-payment or delay in payment of deposits like fixed deposits

- Failure to issue or delay in issuing drafts, cheques, or pay orders

- Mismanagement of loan accounts

- Refusal or delay in sanctioning loans without valid reason

- ATM, debit card, or credit card related issues

- Unauthorized transactions are not being resolved by the bank

In short, if a bank or financial service provider has acted unfairly, violated your rights, or ignored your complaints, you have the right to approach the RBI.

What is the Process to File a RBI Consumer Complaint?

At eDrafter, we make the entire complaint-filing process simple and structured. Here’s how it works:

STEP 1: Fill the form with your details: Start by giving us your basic information and the nature of your grievance.

STEP 2: Consultation with our lawyer: Our team of legal experts reviews your case and guides you on the best way forward.

STEP 3: Drafting and filing a legal notice: The lawyer prepares a well-drafted legal notice and sends it directly to the concerned bank or financial institution.

STEP 4: Wait for the reply: The company or bank is given time to respond to the legal notice.

STEP 5: Escalation to consumer court: If the issue is not resolved through the notice, we proceed with filing your complaint before the consumer forum for further action.

Following these 5 steps would ensure that your consumer complaint to RBI or against a bank is backed by strong documentation and legal support.

How Can RBI Resolve My Complaint?

Once the RBI receives your complaint, they examine the facts, review the documents, and communicates with the bank or financial institution. The official may suggest a settlement or pass an order directing the bank to resolve your issue. The decision of the official is binding on the bank. However, if you are not satisfied with the outcome, you still have the right to appeal further.

How Can eDrafter Help Me File a Complaint?

Filing a complaint might sound easy, but in practice, it can be tiresome. Many complaints get rejected because of missing documents or poorly drafted applications. This is where eDrafter can assist.

With eDrafter, you don’t have to worry about the technicalities. Our team:

- Prepares your complaint in the correct format

- Ensures all necessary documents are attached

- Submits your complaint through the official RBI consumer complaint online portal

- Keeps you updated on the progress

By using our service, you save time, avoid errors, and increase the chances of your complaint being resolved quickly.

Conclusion

The Reserve Bank of India is the guardian of consumer rights in the financial world. If your bank or financial service provider has treated you unfairly, you do not have to stay silent. You can file a consumer complaint with the RBI and get the justice you deserve. The key is to follow the right process and submit your complaint properly. Platforms like eDrafter make it easier by handling the paperwork and filing on your behalf.