Table of Contents

- What Is the Tax on a Gift Deed?

- Is Gift Deed Exempted from Income Tax?

- How Much Is the Gift Amount Tax-Free?

- How Do You Calculate Tax on Gifts?

- Do You Pay Tax on a Deed of Gift?

- How Do I Claim Gift Tax Exemption?

- How to Save Tax by Gifting Money to Parents?

- How Much Money Can Be Transferred Without Tax?

- How Can I Avoid Gift Tax in India?

- Conclusion

Gifting money or property is a common practice, whether it’s between family members or friends. However, understanding the Gift Deed tax rules is crucial to avoid unexpected tax liabilities. In this blog, we’ll explore the Gift Deed tax implications, exemptions, and ways to minimize tax liability when gifting.

What Is the Tax on a Gift Deed?

A Gift Deed is a Legal Document used to transfer ownership of money, property, or assets from one person to another without exchanging money. Under the Gift Deed Rules in Income Tax, the receiver of the gift may be liable to pay tax if the gift exceeds a certain threshold.

According to the Income Tax Act, gifts received in a financial year above ₹50,000 (from a non-relative) are taxable under “Income from Other Sources.” However, gifts from specified relatives, such as parents, spouses, or siblings, are exempt from tax.

Is Gift Deed Exempted from Income Tax?

Yes, there are situations where gifts are exempt from income tax. If a gift is received from a close relative (as per the Income Tax Act), it is not taxable. Additionally, gifts received on special occasions such as marriage, inheritance, or charitable trusts are also exempt.

How Much Is the Gift Amount Tax-Free?

In India, the tax-free limit for gifts depends on the source and the amount:

- Gifts from relatives (as per the IT Act) – Fully tax-free

- Gifts from non-relatives – Taxable if above ₹50,000 per year

- Wedding gifts – Fully tax-free

- Inheritance – Fully tax-free

If the gift is a property, the property Gift Deed tax applies based on the stamp duty and fair market value.

Also Read; Will vs Gift Deed

How Do You Calculate Tax on Gifts?

If a gift is taxable, the receiver must include it as “Income from Other Sources” while filing their income tax return. The Gift Deed tax rate follows the applicable income tax slab of the receiver.

For example:

- If you receive ₹1,00,000 from a friend, ₹50,000 will be taxable based on your tax slab.

- If you inherit ₹10 lakh from a parent, it is not taxable.

Do You Pay Tax on a Deed of Gift?

A deed of gift is taxable only if it does not qualify under the Gift Deed exemption in income tax. If the gift exceeds ₹50,000 and is received from a non-relative, it is subject to taxation. However, gifts from parents, spouses, or during marriage are tax-free.There are various common errors that can invaidate a gift deed that one should avoide while creating a gift deed.

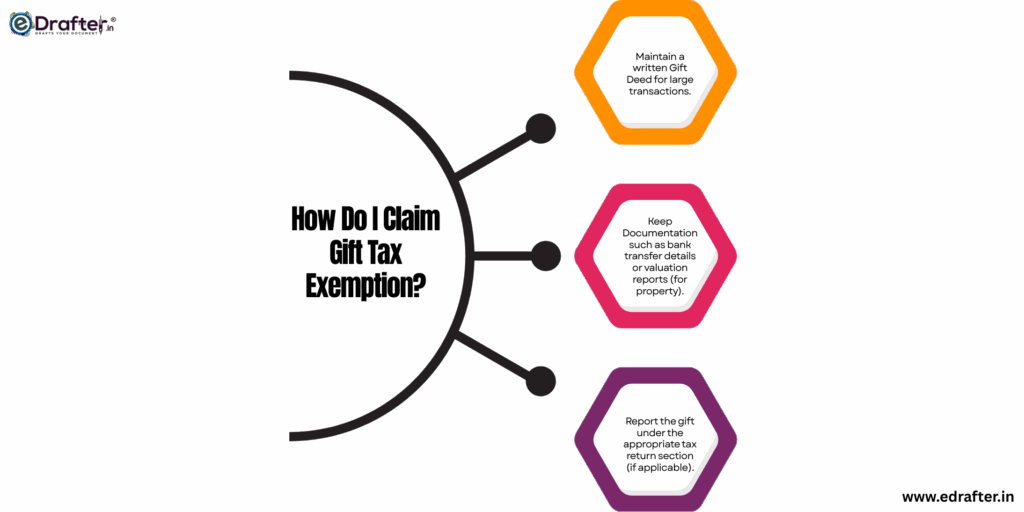

How Do I Claim Gift Tax Exemption?

To claim Gift Deed exemption in income tax, you should:

- Maintain a written Gift Deed for large transactions.

- Keep Documentation such as bank transfer details or valuation reports (for property).

- Report the gift under the appropriate tax return section (if applicable).

How to Save Tax by Gifting Money to Parents?

One smart way to save tax is by gifting money to parents, especially if they fall in a lower tax bracket. Here’s how:

- Parents can invest the gifted amount and earn tax-free income if it falls within the exemption limit.

- If parents are senior citizens, they enjoy higher exemption limits on interest income.

This way, you can distribute wealth within the family while optimizing tax liability.

Also Read; Is Gift Deed Possible Without Blood Relation?

How Much Money Can Be Transferred Without Tax?

The tax-free limit for money transfers in India depends on the recipient and the purpose of the transfer:

- To Relatives – Any amount transferred to parents, spouse, children, or siblings is fully tax-free under the Gift Deed Rules in Income Tax.

- To Non-Relatives – Up to ₹50,000 per financial year is tax-free. Any amount exceeding this is added to the recipient’s income and taxed accordingly.

- Wedding Gifts & Inheritance – Completely exempt from income tax, regardless of the amount.

- Bank Transfers – There is no upper limit for transferring money via bank accounts, but large transactions may be scrutinized by tax authorities.

- Cash Transactions – Transfers above ₹2 lakh in cash are discouraged and can attract penalties.

To ensure compliance, Document large transactions with a Gift Deed and use banking channels for transfers.

How Can I Avoid Gift Tax in India?

While gifting is generous, it’s important to plan it wisely to minimize Gift Deed tax implications. Here are some effective ways to Legally avoid or reduce Gift Deed tax in India:

- Gifting to Relatives – Gifts to parents, spouses, children, and siblings are tax-free under the Gift Deed Rules in Income Tax.

- Wedding & Inheritance Gifts – Any amount received during marriage or as inheritance is exempt from income tax.

- Gifting to Parents & Investing – Transferring money to parents (especially senior citizens) helps reduce tax liability as they have higher exemption limits.

- Using the ₹50,000 Limit – Gifts from non-relatives up to ₹50,000 per year are tax-free.

- Gifting Assets Instead of Cash – Property gifts to relatives are tax-free, but stamp duty applies.

- Providing Interest-Free Loans – Instead of gifting large amounts, offer an interest-free loan to avoid tax.

Always Document transactions with a Gift Deed to ensure compliance with Gift Deed rules in income tax.

Also Read – How to Cancel Gift Deed

Conclusion

Understanding Gift Deed tax implications is essential before making or receiving gifts. While gifts from relatives and on special occasions are exempt, gifts from non-relatives exceeding ₹50,000 attract tax. By following the right strategies, such as gifting money to parents or Documenting transactions, you can minimize tax liability effectively. Always consult a lawyer before making significant gifts to ensure compliance with the Gift Deed Rules in Income Tax.