Biggest e-Stamp Paper Store of India

Choose Your State

How it Works?

Fill Your Details

Choose Your Stamp Duty and Make Payment

Delivery of Your e-Stamp Paper on your email / doorstep

Benefits of Buying Stamp Paper from eDrafter.in

Quickest Delivery

Your Stamp Paper will be Delivered within 2 hours once you place your order

Best-in-Class Support

We have 24/7 live chat bot and a trained team to handle all your queries.

9 Years of Trust

We are leading the market since 6 years and served million of users the best in class solution to provide Stamp Paper.

Frequently Asked Questions

▸ What is e-stamp paper?

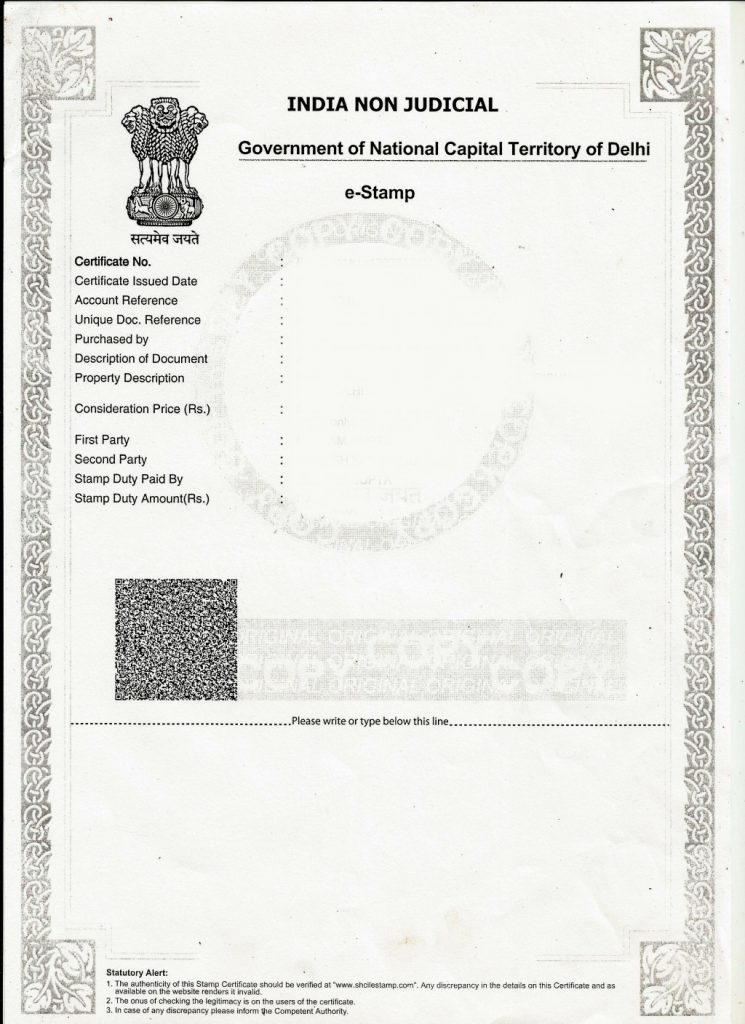

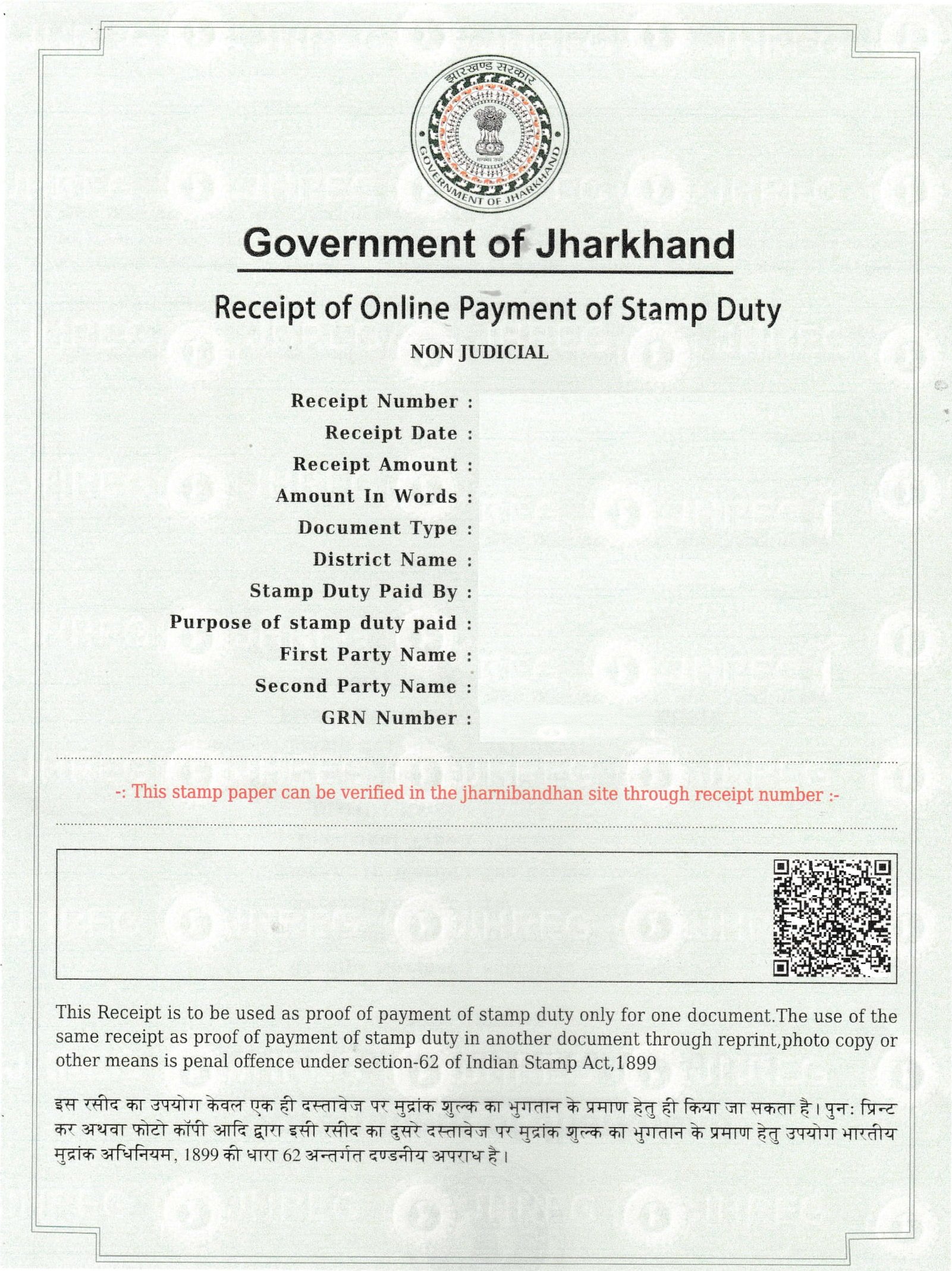

e-stamp paper is a computer-based application and a secure way of paying non-judicial stamp duty to the government. Please note that e-stamp paper means paying stamp duty electronically to the government; it does not mean that the government shall provide a soft copy of e-stamp paper. This service is available in a few states only like Haryana & Jharkhand; in other states the e-Stamp paper gets available through SHCIL.

▸ What is Stamp Duty?

It is a type of tax collected by the State Government.

▸ What are the different types of Stamping processes in India?

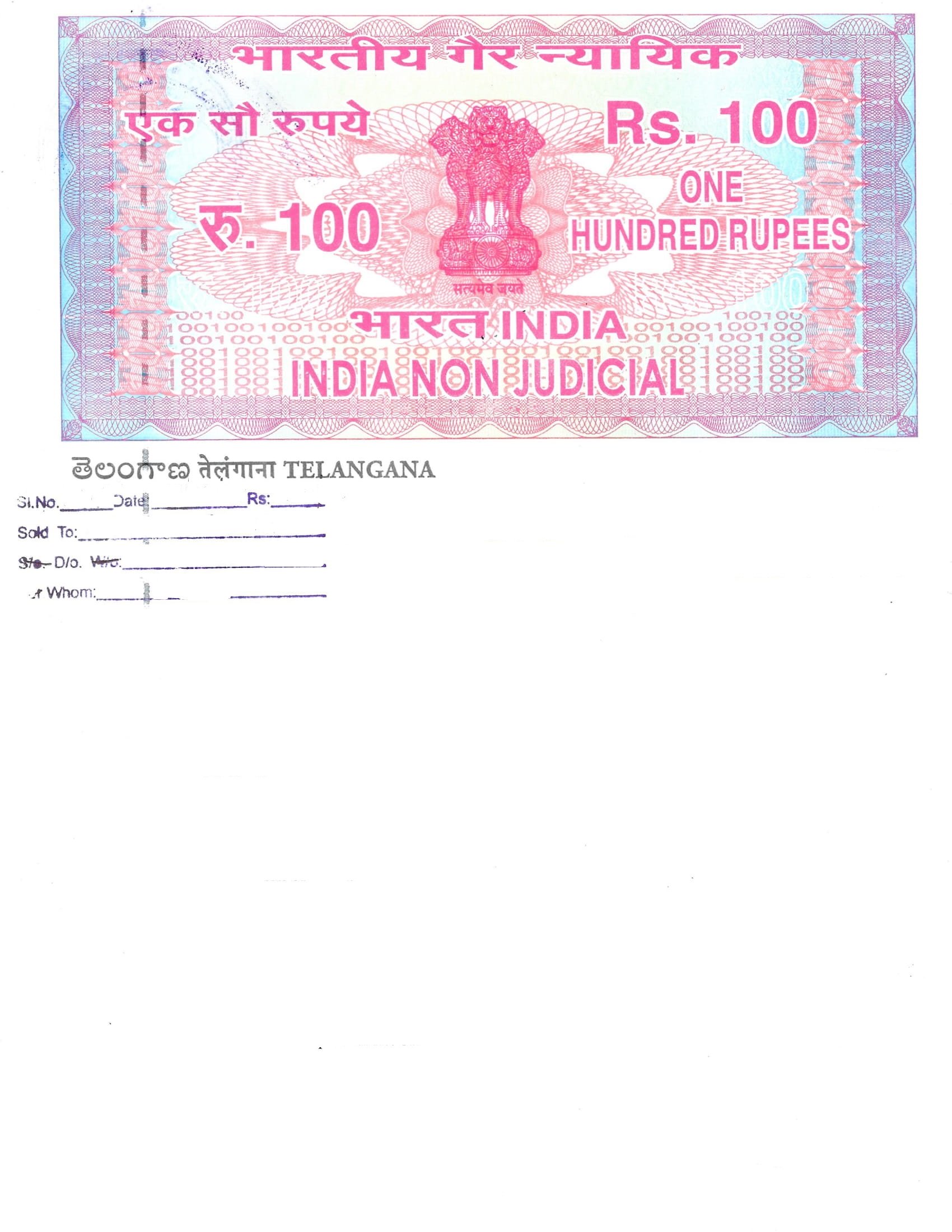

There are mainly three types of stamping processing that are legally valid in India:

- Stamping through Court: There are some states where the stamp paper procurement is physical through courts wherein one needs to visit the Government authorized stamp vendor and need to furnish the details.

- Stamping through SHCIL: The Government of India has appointed SHCIL as the only Central Record Keeping Agency (CRA). The citizens can pay stamp duty online and later on they will get a hard copy of the e-stamp paper. For the same, they can visit the authorized collection center. Currently stamping through SHCIL is available in 18 States.

- Stamping through e-gras: The Online Government Receipts Accounting System (e-GRAS). There are very few states where stamping through e-gras is applied where the public need not be present physically, they get their stamp papers online without any long hefty process.

▸ What is the difference between judicial & non-judicial stamp paper?

Judicial Stamp Paper | Non-Judicial Stamp Paper |

| Those Stamp Papers which are directly used in courts by the judge to give verdicts are Judicial Stamp Papers. | Stamp Papers used directly for the execution of the documents are Non-Judicial Stamp Papers. |

| Judicial Stamp Papers are something related to the administration of justice that is used. | Non-judicial stamp papers are used for things like commercial agreements, powers of attorney, and property transfers. |

| Under the Court Fees Act of 1870, stamp duty on judicial stamp paper is paid. | The Indian Stamp Act of 1899 governs the payment of stamp duty on non-judicial stamp paper. |

▸ How to buy Stamp paper online or where to find Stamp paper near me?

To buy e stamp paper online you need to follow a few steps, they are

- Go to the website.

- Choose the option of buy e-stamp paper

- Choose the State of which you want to buy the e stamp paper online. For example, if you want e-stamp paper Delhi then select the desired option.

- Fill out the given form and then Add to Cart your stamp paper, choose the service you want.

- After that place the order and you will get scan copy at your email & hard copy at your doorstep.

▸ How the stamp duty differs from state to state?

Stamp duty means a Stamp paper value/denomination which generally depends upon the nature of the Document; One needs to make sure while paying stamp duty that you need to pay an appropriate stamp duty to the Government; if you pay a lesser value then the Document shall be considered invalid hence it is always advisable to pay appropriate stamp duty as per the Stamp Act of the concerned State Government.

Further, as the question says the stamp duty differs from state to state as that is being hold by the state government.

We’re sharing Stamp Duty details of a few states; Please refer:

- Stamp Duty Haryana – In Haryana, the e-stamp paper has been introduced by e-Grass wherein the 101 and higher values are available online whereas if one needs to buy 100 or lesser value then have to approach physically to the Stamp Vendors; the commonly used e-stamp paper in Haryana is 101 which can be used for Affidavit, MOU, Agreement and other.

- Stamp Duty Mumbai/ Stamp Duty in Pune – With Maharashtra Government, only two values are available 100 & 500. Also, please note the Stamp Act as below:

- Stamp Duty in Rajasthan: In Rajasthan, the starting value of stamp duty is 50 in which an affidavit is normally made, and for the agreement, 100 value stamp paper is commonly used and the government charge 40% surcharge on stamp duty value.

- Stamp duty West Bengal: The starting stamp paper value is 20 on which affidavits are commonly used and 50&100 are often used for agreements.

- Stamp Duty Gujrat: In Gujrat, the affidavits are often made on the value of 50 which is the starting value and the agreement is commonly made on the value of 300 stamp duty.

- Stamp Duty of Sates associated with SHCIL: The states which are associated by SHCIL have a separate stamp article which can be referred to at this link https://www.shcilestamp.com/

▸ How can I verify the authenticity of an e-Stamp?

Authenticity of e-Stamp can be verified through these Steps:

- Open the website shcilestamp.com

- After that Click on “Verify e-Stamp Certificate

- Fill the Required Details.

Details include:

- State

- Certificate Number(UIN)

- Stamp Duty Type(Description of Document)

- Certificate Issue Date

- 6 character alphanumeric string

▸ What is Unique Identification Number (UIN)?

UIN is a unique system-generated number mentioned on the e-Stamp Certificate. Anybody, having the Unique Identification Number can check the authenticity of the Certificate through www.shcilestamp.com

▸ Who covers under Second Party?

Second Party can be Tenant, Vendee, Transferee, Donee etc.

▸ Is only First Party can be the purchaser of e-Stamp Paper?

No, e-Stamp Paper can be purchased either by First Party or by Second Party.

▸ What is meant by Description of Document?

Description of Document means the Purpose for which you are purchasing the e-Stamp paper. Description of Document includes Affidavits, Indemnity Bond, Rent Agreement etc.

▸ What is Consideration Amount?

Consideration amount is the total value of funds involved in any purchase/sale transaction entered between two or more parties.

▸ Is it possible that more than one person can purchase a single e-Stamp Paper, If yes than whose name will appear on e-Stamp Paper?

Yes, it is possible to purchase a single e-Stamp Paper on the names of more than one person and the format of names on e-Stamp Paper will be like: First person Name & Others.