Limited Liability Partnership (LLP) Registration

Online in India

We will Register your LLP effectively and efficiently in

15 Days Only!

Start Your LLP Company with one Tap on finger

Best service thank you Team

The entire process was seamless and Sunil Chauhan was proactive in getting things done. Really liked the overall service and recommend it to others.

Great services must recommended 👌

Great experience. Mr. Pushpendra Singh helped me a lot for my Work for affidavit.

I reallt worthfull for me for having a good experience with eDrafter …thanks Sunil Chauhan ji for a good job 👍 good work as expected.

“Excellent service! Kaam bahut jaldi aur professional tarike se hua. Fully satisfied with the support. 5 Stars!

Very smooth and easy process, highly recommended

Pushpendra provided the stamp papers in a timely manner

Very active and fast service

Very nice service and staff. I will strogly reccomend to avail.

I had a great experience with eDrafter. I ordered a Karnataka stamp paper and was pleasantly surprised to receive the scanned copy in barely 20 minutes. The platform is easy to use, the communication is clear, and the delivery is extremely quick. I truly appreciate the prompt assistance provided by Shubham Sharma throughout the process. Highly satisfied and definitely recommend their services!

Helped me a lot. Definitely recommended.

Great work Thanks to Mr. Sunil Chauhan 👍

Process was smooth and easy. They reverted back to my request in 1 day. I would definetly recommend to use their services for fast and easy process. Gave 4 star as cost of services can still be at better levels. As volumes in online services will be more, team can work on better pricing. This will inturn increase the volumes.

Sunil ji made the experience seamless. Top Quality service provided by eDrafter.

Best & Fast Service

Thank you so much

I used edrafter for my partnership deed and these guys did a wonderful job and I’m very much satisfied with the service of sirjan Singh. Thank you so much and will give lot more orders to easier my processes.

Awesome delivery

eDrafter provided very good Services they made everything very Easy and Smooth. Sunil Chauhan really, he is doing very well. I took Rent agreement he provided me in 5-6 hrs. very smoothly. I strongly recommended to my friends also

Prompt and perfect experience – Needed a stamp paper, and very professional work done by Sunil Chauhan

Good service

Thank you, Mr. Sunil Chauhan for processing the print-on stamp paper swiftly in less than 5 hours. It was really helpful understanding my urgency.

Good professionalism displayed by the team. Team was supportive throughout and made the process look smooth.

Pushpendra Singh, I am share my appreciation for your service. You were extremely helpful with the affidavit.

Very convenient to use and helpfull. The team supports well and I was having an emergency so wasn’t able to go for a offline process this made it easy for me.

Pushpendra Singh (operations executive – B2C)

I received physical copy which has wrong details instead of latest draft which was written with correct details. So basical final scanned copy and physical copy received are different!

Your service is very useful and Short time.. thanks

It was a great experience and the work was very nice

they print on normal paper for rental agreement ,have to followup lotbof times to change text

I have used eDraft services and i found it most convenient. Staff is very well trained and understand the need of customer which is very good.

Very prompt and efficient service by Mr. Sunil Chauhan from the eDrafter team

Good work

Reliable, fast and quick service to get your notary and legal work done.Only feedback would be to have more explanatory options during checkout section to make more sense of the services available

Fast and quick service. Thank you Mr. Shubham Sharma

Worst experience and fraud agency !!!! Opted for the very basic service for name change and Gazette publication. They were very prompt in communication and follow up until I have made full payment. But after that there is no proper response for email, not attending the calls or returning back the same. They are now asking me to follow up directly with government employees in Delhi for the Gazette publication. I have lost my money, now I am looking for any other reputed team for Gazette publication. Do not fall in their trap, I would never recommend this agency

What is a Limited Liability Partnership?

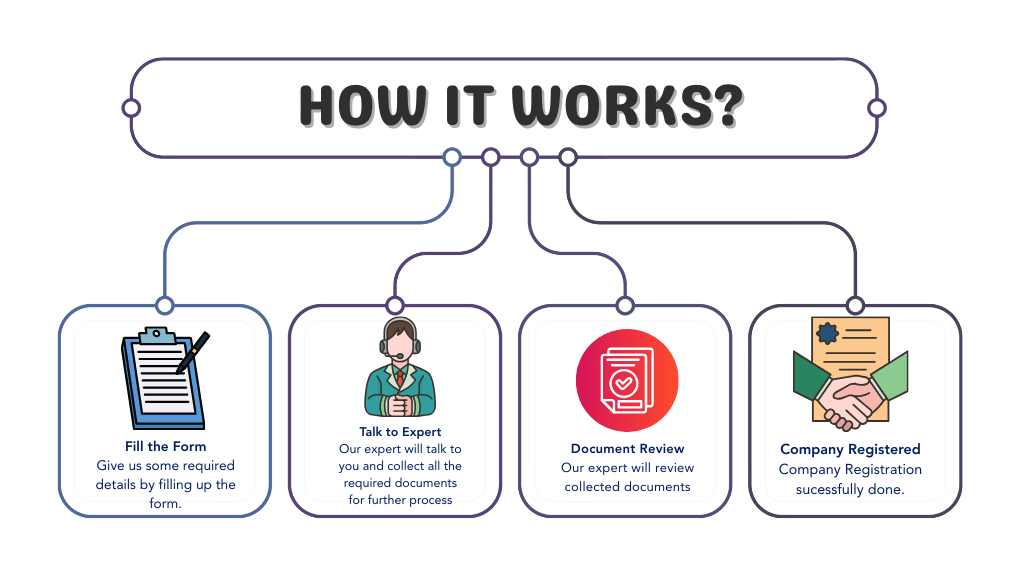

How to Register an LLP Company in India?

Step-1

Document Verification

Verify the necessary documents for registration

Step-2

DPIN for all Partners

Obtain Partner Identification Number

Step-3

DSC for 2 Partners (Valid for 1 year)

Obtain Digital Signature

Certificate

Step-4

Name Search (4 Options allowed)

Submit name choices for approval

Step-5

Name Registration

Register the chosen company name

Step-6

LLP Deed Drafting & Execution

Drafting of partnership deed & execution

Step-7

LLP Registration

Complete the company registration process

Step-8

LLP Certificate

Issue partnership certificates to shareholders

Featured on

Benefits of Private Limited Company Registration

Separate Legal Identity of the Company

Private Limited Company Registration gives separate Legal identity to the Company.

Limited Liabilities on partners

Limited Liabilities on partners as personal & company assets are considered separately.

Liberty to have International Partners

Pvt Ltd gives liberty to have international partners, only partner is required to be an Indian Citizen

No Minimum Capital is Required

For LLP Formation and Registeration, you don’t required any minimum capital .

Detailed Comparision Between Types Of Companies in India

| Aspect | PVT LTD | OPC | LLP |

|---|---|---|---|

| Act | The Company Act 2013 | The Company Act 2013 | The LLP Act 2008 |

| Minimum Number of Directors/Partners | At least 2 Directors Required | At least 1 Director Required | Minimum 2 Partners will be required |

| Maximum Number of Directors/Partners | Maximum 15 Directors a Company Can Have | Maximum 15 Directors a Company Can Have | No Limit |

| Maximum Members/Shareholders | Maximum 200 Members/Shareholders are allowed | Only One | No Limit |

| Authorized Capital | Minimum 1 Lakh | Minimum 1 Lakh | No Minimum Capital Required |

| Eligibility Criteria | Any Person May Form a Private Limited Company, but any of them should be an Indian Resident | A Person who is Resident of India | Any two Person who is Major and at least one of them must be an Indian Resident |

| Put After Name | Pvt Ltd | OPC | LLP |

| Liability of Shareholders/Partners | Shareholder’s Liability is Limited to their Allotted Capital | Liability is Limited to Member’s Capital | Liability of Partners is Limited to their Agreed Contribution |

| Any Changes in Business | Filling Form 32 with ROC | Filling Form INC-4 with ROC | Filling Form 3 with ROC |

| Existence | A Private Limited Company has a Perpetual Succession since any changes will not affect its existence. | A Private Limited Company has a Perpetual Succession since any changes will not affect its existence. | A LLP Company has a Perpetual Succession since any changes will not affect its existence. |

| Transfer of Ownership | Can Transfer Ownership by Transferring Share | Can Transfer Ownership | LLP Ownership is Wholly or Partly Transferable. |

| Business Conversion | Can Be Converted into LLP, OPC or LTD | Can be Converted into LLP or PVT LTD | LLP Can be Converted into Company |

| Maintaining Books of Accounts | Mandatory | Mandatory | Mandatory |

| Maintaining Books of Statutory Records | Mandatory | Mandatory | Mandatory |

| Provision for Public Deposit | Sec. 73 of The Company Act 2013 | Sec. 73 of The Company Act 2013 | No Provision |

| Provision for Loan to Directors | Sec. 185 of The Company Act 2013 | Sec. 185 of The Company Act 2013 | No Provision |

| Board/Partners Meeting | First Meeting should be held within 30 Days from Incorporation, After First Meeting Minimum 4 Meeting in a Calendar year Should be Hold. | NA | Not Required |

| Statutory Audit | Mandatory | Mandatory | In Case Turnover is More than 40 Lakh or Partners Contribution Exceeds 25 Lakh. |

| Internal Audit | Companies Having Turnover of 200 Crore are applicable for Internal Audit | NA | NA |

| Income Tax Audit | Turnover above 1CR | Turnover above 1CR | Turnover above 1CR |

| Income Tax Rate | 25% | 25% | 30% |

| Income Tax Return | ITR-6 | ITR-6 | ITR-5 |

Frequently Asked Questions

Frequently Asked Questions (FAQs) ▸ What is LLP Registration?

In India, the Limited Liability Partnership (LLP) idea was first presented in 2008. The LLPs in India are governed by the Limited Liability Partnership Act, 2008. Incorporation of an LLP requires a minimum of two partners. However, a LLP may have an unlimited number of partners as well as the limited liabilities which are enjoyed by the shareholders. A Limited Liability Partnership has a separate corporate business entity and gives the benefit of flexibility in partnership as well.

How much time it will take for the registration ?

It will generally take 5-6 working days for LLP firm registration.

What are the Documents required for Limited Liability Partnership Registration?

The documents required for Private Limited Company registration are as follows:

. PAN Card of the Directors

. Aadhaar Card of the Directors

. Bank Statement

. Latest Electricity Bill

. Latest Mobile Bill

. Passport size Photograph of the Directors

. Board Resolution Authorising Investment.

. Investing Company Address Proof

. Recent Utility Bill for Business Purpose

▸ What will I get after we register the company?

You will get a registration certificate that will notify that your firm is successfully registered.

▸ What is an LLP Agreement?

It is a written document which discusses all the duties and responsibilities amongst the partners and also the nature of the business.

▸ What should be the minimum turnover for LLP?

The minimum turnover for a Limited Liability Partnership should be 25 lakh approx.

▸ What are the advantages of LLP?

The advantages are as follows:

- No minimum capital contribution is required.

- Limited Liability.

- Credibility.

- No partners can be unlimited.

- Perpetual Succession.

- The employees enjoy flexibility in work.

- Partners are not liable to pay taxes on their total Revenue.

- Can be dissolved easily.

- Separate legal entity.

▸ Can LLP be converted into Pvt Ltd.?

According to Section 366 of the Companies Act, 2013 and Company (Authorized to Register) Rules, 2014 says that a Limited Liability Partnership company can be converted into a Private Limited Company. For the businessmen who convert their company from LLP to Pvt Ltd their major objective is to raise the growth of the company.

▸ Can one person start LLP?

At least two shareholders are required to start a Limited Liability partnership, else there are no restrictions on the number of partners and members in it. The two people should be residents of India.

▸ Is GST required for LLP registration?

Every LLP that provides GST-exempt goods and services is required to register for GST. A GST registration can also be necessary, depending on the turnover.

▸ What is a Digital Signature Certificate(DSC)?

Usually, one Notice by an Advocate on behalf of a client suffices. However, the client has the right to communicate personally also for settlement of the issue. And that communication serves as the part of the plaint/complaint.

▸ What is a liability of a partner in LLP?

Liability of a partner in LLP is very limited, in the case of bankruptcy the institution is only allowed to seize the assets which are registered by the business and no personal assets are harmed.