Hello to all our Readers!

Today in our this blog,We will discuss about How to Refund the e-Stamp Paper.

The Refund of e-Stamp Paper can be done but before the limitation period gets expired. There is a limitation period of 6 months after that the e-Stamp Paper can not be refunded. So, if you are going to refund the e-Stamp Paper make sure that it fits under this criteria.

How to Refund e-Stamp Paper?

Write the Application for the Refund of e-Stamp Paper with following Documents:

- Original e-Stamp Certificate.

- Self Attested Copy of I.d Proof.

- Affidavit on prescribed proforma on Rs. 10/- stamp paper.

- Indemnity Bond on prescribed proforma on Rs. 100/- stamp paper (provide Indemnity Bond only if the e-stamp paper has been signed by both the parties).

- Prescribed refund proforma in duplicate duly signed each on Rs. 1/- revenue stamp by the applicant.

Note: If the applicant is not in the position to move in the Office for the process of refund then he/she can provide the authority letter duly affixed with Rs. 2/- Court fee stamp.

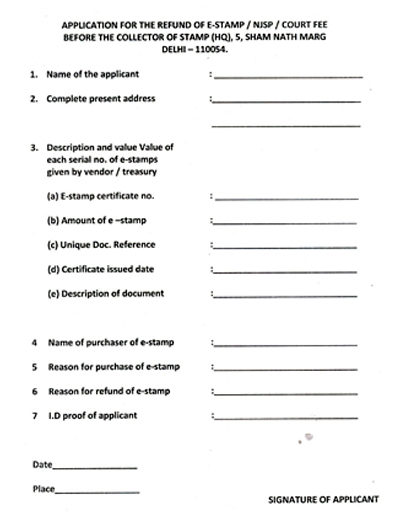

Sample of Application for the Refund of e-Stamp

Under What Circumstances the refund of e-Stamp paper can be acceptable?

- Stamp Paper UN-used OR Spoiled.

- As per the Order of Court, the e-Stamp Paper needs to be refunded.

- If the Stamp Duty has been deducted twice on the same document due to any technical issue.

- Mistakenly paid Stamp Duty to another Department apart from concerned department.

- Paid excess Stamp Duty.

- Cancellation of e-Stamp Paper by court due to the reason that judicial stamp paper is required not non judicial.

- Cancellation of the Agreement with another party.

So, these are few circumstances in which the application of refund of e-stamp paper can be acceptable. So, if you are going to refund the e-Stamp papet then firstly its recommended to have a look at the circumstances in order to avoid the rejection of application.

How Much Stamp Duty is refunded by the Department?

The Stamp Duty is refunded by the concerned Department after deducting 10% of the Total Amount of the Duty Paid.

So, this is all about the Refund process of e-Stamp Paper. If you have any queries regarding this then Feel free to comment on our blog and we will surely help you in best possible manner.

Information about Us – We, eDrafter.in provide Non Judicial e-Stamp paper at doorstep in which you just have to fill the form and we will deliver your e-stamp paper at your place. To know more Kindly have a look at our this section – Non Judicial e-Stamp Paper

Thank you for reading.

Have a Pleasant Day!